Mohamed Al Lamki, Unit Head - Transaction Banking

What makes ‘Alizz Connect’ stand out as a digital transaction banking platform for Alizz Islamic Bank’s corporate customers?

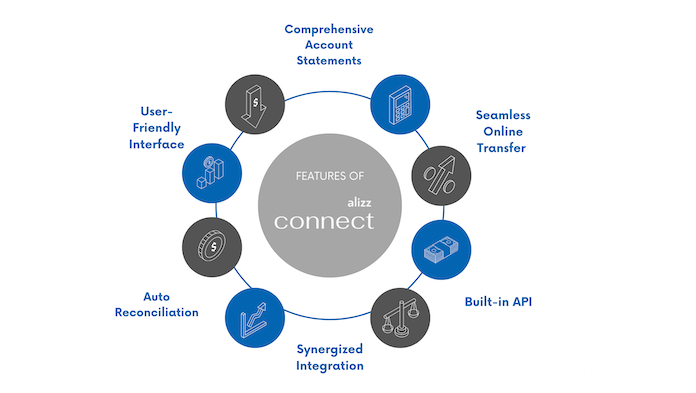

Alizz Connect is designed with our wholesale banking customers in mind, offering a user-friendly interface that ensures ease of navigation. Its direct integration into the bank’s core banking system provides robust functionality, allowing seamless access to banking services. Additionally, the platform boasts unique features such as customer-controlled payment solutions for auto reconciliation of accounts and comprehensive corporate account statements, making it a leading choice in the market.

How does the new User Interface in Alizz Connect enhance the user experience?

The revamped user interface of Alizz Connect offers a clean and intuitive design with simplified navigation. Our customers can easily access and manage their accounts, perform transactions, and utilise key banking features without any hassle. This focus on user-friendliness ensures that customers can perform complex banking operations with ease and efficiency.

Explain the direct integration between Alizz Connect and the bank’s core banking system?

Alizz Connect allows real-time updates and seamless access to critical banking functions without the need of any middleware. This integration ensures that corporate customers can view their balances, make payments, and manage accounts without delays. It also strengthens the platform’s reliability and ensures that all transactions are processed securely and efficiently.

One of the unique features of Alizz Connect is the customer-controlled payment solution for auto reconciliation. How does it work?

The customer-controlled payment solution is a standout feature that allows businesses to manage their payments with precision. It supports auto-reconciliation of accounts, ensuring that incoming and outgoing payments are automatically matched with the company’s unique and customizable reference numbers, like invoices. This feature reduces the time and effort spent on manual reconciliation, enhances accuracy, and gives corporate customers greater control over their financial operations. This integration enables automated processes such as payroll, invoicing, and supplier payments, which can be directly linked to the corporate customer’s banking system. As a result, businesses can streamline their operations, reduce manual intervention, and improve efficiency.

What makes Alizz Connect stand out?

Alizz Connect offers the most comprehensive corporate account statement by providing detailed, real-time insights into a company’s financial activities. It includes not just basic transaction history but also detailed categorisation of payments, account balances, and reconciliations; allowing businesses to get a full, in-depth view of their finances. This level of transparency helps in better financial management and decision-making.

Alizz Connect offers one-time online transfers without saving a beneficiary. How does this feature improve convenience for customers?

The one-time online transfer feature of Alizz Connect allows corporate customers to make immediate payments without the need to save a beneficiary first. This is particularly useful for businesses that frequently make immediate payments to different vendors or partners. It streamlines the payment process by eliminating the need for additional steps, while still ensuring security and compliance, offering greater convenience and flexibility.

How does Alizz Islamic Bank add value to its corporate customers through Alizz Connect?

Alizz Connect adds significant value by providing a comprehensive digital transaction banking platform that is tailored to meet the specific needs of businesses. The platform simplifies complex banking processes, offering features like customer-controlled payment solutions, B2B API integration, and detailed account statements. By ensuring seamless, secure, and efficient financial operations, Alizz Connect helps businesses manage their cash flow, improve operational efficiency, and focus on growth, ultimately driving greater financial success.